How much debt do you have? Do you have a plan to pay it off? If you completed the Expense Template then you should know how much debt you have. If you have not completed the Expense Template or didn’t know about it, then click here or just take a sheet of paper and list everyone you owe (even if you are not paying them at the moment), the payment amount, the current debt balance, interest rate and the frequency of the payment (weekly, every 2 weeks, monthly, etc). Total up the payment amounts and the debt balances.

Now that you know how much debt you have, it's time to plan a method of attack. Paying off debt is really a personal choice, but I will provide 3 methods below and tell you which one I used.

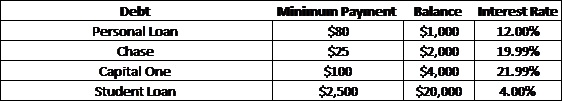

Debt Avalanche. With the debt avalanche your debt is paid off in order of highest interest rate to lowest interest rate. This option allows you to pay the lowest amount of interest but you may need to set incremental goals to keep you motivated. Once you pay off the first debt, take the minimum payment of the first debt add it to the minimum payment of the next debt and began paying that debt off. For example:

*I made these numbers up so the minimum payments compared to interest rate are not accurate.

Using the Debt Avalanche method, you would pay off your debt in the following order.

Once you pay off the Capital One Credit Card, you will to pay $125 on the Chase Credit Card.

Debt Snowball. In the debt snowball method, you pay off your debt from smallest to largest amount. In this method you will pay more in interest, but it creates more motivation because you are able to achieve small wins at a quicker pace, which will help you to keep going.

Here is the order you will pay off your debt using the debt snowball method.

You will still roll over your minimum payment to the next debt. So once you finish paying off the personal loan. The minimum payment to the Chase Credit Card will be $105.

Emotional Debt Method. OK. OK. I made this up myself, but its real and I always say that personal finance is personal. So if there is a debt that irks you to no end. Pay that off first (yes, even if it is the student loan), you will feel better. Same rules apply, when you finish paying off the student loan roll the minimum to your next debt. You can also combine this method with one of the other methods, for example pay off the debt that bothers you first and then debt snowball the rest. My favorite method is the Emotional Method (I need an official name) because that is what I used to pay off my debt. There was one debt that I was annoyed with and tired of paying so all my effort went to paying off that debt first and then I debt snowballed the rest.

So let’s look at your pay off order base on hating that student loan.

In order to speed up the payoff process there are a couple things you can do:

Pick up a side hustle. I just published some side hustles to help you get started. When I was paying off my debt, I was working part-time at a local community college teaching Accounting, I also mystery shopped and did surveys. The extra income helped me pay off my debt faster.

Look at your spending habits. Do you have extra money you can allocate toward debt? Can you reduce the amount of times you eat out on a monthly basis and put the savings toward debt or maybe cut the cord (cable)? If there is room in your budget to allocate money toward your debt payoff.

Which debt payoff method do you prefer? Let me know in the comments below.